Difference Between Short Term and Long Term Capital Gains

Table of Contents

Key Difference – Short Term vs Long Term Capital Gains

Capital gains are increases in the value of capital assets over and above the purchase price. This increase in value is based on the demand and supply for the asset. If there is a well-established market for the asset, there is a readily available market price that is subjected to fluctuations. The key difference between short term and long term capital gains is that short term capital gains are obtained by sale or exchange of capital assets held for a one year or less whereas long term capital gains are the gains resulting from sale or exchange of capital asset held for more than one year.

CONTENTS

1. Overview and Key Difference

2. What is Short Term Capital Gains

3. What is Long Term Capital Gains

4. Side by Side Comparison – Short Term vs Long Term Capital Gains

5. Summary

What is Short Term Capital Gains?

A short term capital gain is a gain realized by the sale or exchange of a capital asset which had been held for a time period of one year or less.

Ex: An investor subscribe for 200 shares in SDF Company on 01.25.2016 for a price of $15 per share. He sells the shares on 11.20.2016 when the price per share has increased to $19. Thus, the capital gain will be,

Capital gain= (200* $19)-(200* $15) = $800

Capital gain as a percentage= $800/ $3,000* 100= 26.6%

One of the most important implications that should be considered with regard to capital gains is the tax rates. Short term gains are taxed at the taxpayer’s marginal tax rate (tax amount payable on an additional unit of income where the tax amount increases as the income rises). This type of tax is referred to as a ‘capital gains tax’.

Capital assets may experience short term losses as well. In such a circumstance, a loss can be set off against a short-term gain and the net result will be in effect for tax payment. A taxable capital loss is limited to $3,000 for single taxpayers and $1,500 for married taxpayers.

What is Long Term Capital Gains?

Long term capital gains are realized by sale or exchange of a capital asset that has been held for a time exceeding one year. Continuing from the same example,

Ex: Assume that the above investor holds the shares for 7 years. Within the 10 year period, the value of the shares have fluctuated upwards and downwards and overall, the value has increased to $ 27 per share. Thus, the capital gain will be,

Capital gain = (200* $27)-(200* $15) = $2,400

Capital gain as a percentage = $2,400/ $3,000* 100= 80%

Long term capital gains are taxed at a favorable rate compared to ordinary income and short term capital gains. Long term capital gains are also taxed at the marginal tax rate. The percentage of tax payable according to the marginal tax rate is shown in the below table.

| Marginal tax rate | Long term capital gains tax rate |

| 10% | 0% |

| 15% | 0% |

| 25% | 15% |

| 28% | 15% |

| 33% | 15% |

| 35% | 15% |

| 39.6% | 20% |

Like in short term capital gains, long term capital gains can also be used to set off long term capital losses. Furthermore, investors can also claim short term capital losses against long-term capital gains.

Ex: An investor has a long term capital gain of $50,000 and a short term capital loss of $3,000. Thus, he/she only has to report the difference of $47,000 for tax purposes.

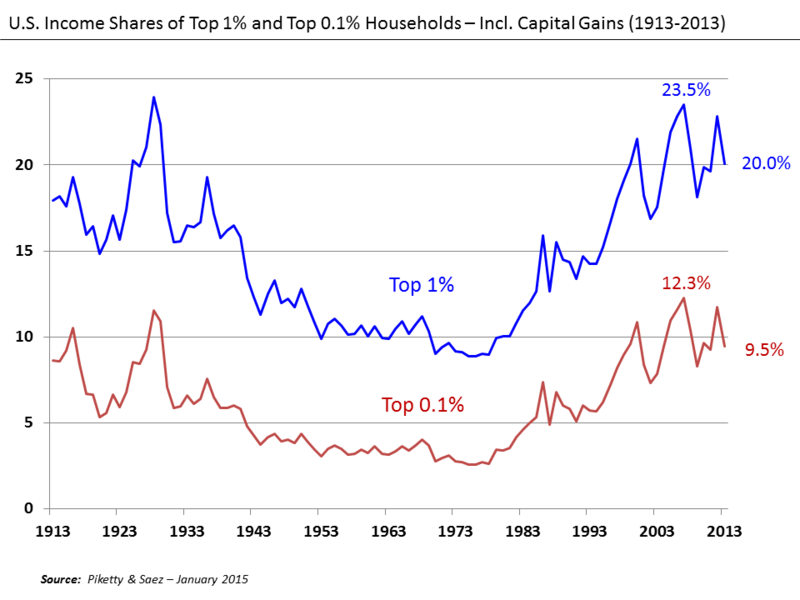

Figure 1: Capital gains are subjected to fluctuations

What is the difference between Short Term and Long Term Capital Gains?

Short Term vs Long Term Capital Gains | |

| Short term capital gains are obtained by sale or exchange of capital assets held for a one year or less. | Long term capital gains are the gains resulting from sale or exchange of capital asset held for more than one year. |

| Tax Rates | |

| Tax rates for short term capital gains are higher than long term capital gains. | Long term capital gains are taxed at a lower rate compared to short term capital gains. |

| Type of Assets | |

| Short term capital gains are usually obtained by sale or exchange of shares. | Long term capital gains are usually obtained by sale or exchange of long term assets such as real estate. |

Summary- Short Term vs Long Term Capital Gains

The difference between short term and long term capital gains primarily depend on the time period they are held before the sale or exchange. Other than the difference with the time frame, their structure and nature are very similar to each other. Both are taxed at marginal tax rate and capital losses can be claimed against capital gains. The longer the assets are held, higher the risk of fluctuations in value. This is the reason why long term capital gains are taxed at a lower rate compared to short term capital gains.

References

1.”Short-Term Gain.” Investopedia. N.p., 22 May 2008. Web. 29 Mar. 2017.

2.”Long-Term Capital Gain Or Loss.” Investopedia. N.p., 29 July 2015. Web. 29 Mar. 2017.

3. Frankel, Matthew. “Long-Term Capital Gains Tax Rates In 2017.” The Motley Fool. The Motley Fool, 01 Jan. 1970. Web. 29 Mar. 2017.

Image Courtesy:

1. “U.S. Income Shares of Top 1% and 0.1% 1913-2013” By Farcaster at English Wikipedia (CC BY-SA 3.0) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26%2Fx6iprWWkmr%2BuecCnm2auo2K5sLrGZqueqp1isKK8yK2YpWWXlravv44%3D