Difference Between Share Certificate and Share Warrant

Table of Contents

Key Difference – Share Certificate vs Share Warrant

A share is a unit of ownership of the company. Both share certificate and share warrant are documents that deal with shares of a company. The key difference between share certificate and share warrant is that a share certificate is a proof document issued to indicate the ownership of shares by an investor in a company whereas share warrant is a document that entitles the bearer the right of acquiring shares of the company in the future.

CONTENTS

What is a Share Certificate?

A Share certificate is issued as a proof of certifying that a certain investor is a registered owner of shares in the company on the date the certificate is issued. The company must issue a share certificate within two months of,

- An issue of shares (specified in Company Act 2006, section 769)

- A transfer of shares to another investor (specified in Company Act 2006, section 769)

Components of a Share Certificate

- Name of the company

- Name and address of the shareholder

- Number of shares issued

- Funds paid for the shares

- Classes of shares (created for different purposes to such as to be able to vary the dividends paid to different shareholders, to create non-voting shares, shares for employees or family members)

- Stamp and signature of two directors and the company secretary

Advantages of Investing in Shares

- Higher returns compared to rates offered by banks.

- Returns in terms of both dividends and capital

Shareholders are entitled to two forms of returns by investing in a listed company. They are,

Dividends

This is a sum of money paid to shareholders out of company profits. Dividends are usually paid at the end of the financial year (final dividend) while some companies also pay an interim dividend. Some shareholders prefer to cash in the dividends while others prefer to reinvest the sum of money they are entitled to in the business which is called the dividend reinvestment concept.

Capital Gains

Capital gains are profits earned from the sale of an investment, and these gains are taxed subjected to specific requirements.

e.g.: If an investor purchased 100 shares of a company at $ 10 each (value = $ 1000) in 2016 and if the share price in 2017 has increased to $ 15 each the value in 2017 is $ 1500, where the investor will gain a profit of $ 500 if the shares are sold in 2017

Disadvantages of Investing in Shares

- Higher risk due to the inherent volatility of shares.

- Shares are traded on a daily basis, and share prices are decided based on the demand and supply for shares.

- Investors need to spend time on investment decisions

- If in need for favourable returns, investors should be vigilant and study the stock market changes continuously. This usually consumes significant time.

What is a Share Warrant?

A Share Warrant is a bearer document of title to shares and can be issued only by public limited companies against fully paid up shares. Thus a warrant is a right, but not an obligation to buy a share at a certain price in the future. The issue of share warrants should be authorised by the Articles of Association of the company (One of the main documents that include the purpose and other specifications of the company). Warrants are issued by the company whose stock underlies the warrant and when an investor exercises a warrant, he buys stock from the company.

Advantages of Share Warrants

- Shares entitled to a warrant can be transferred to another investor by mere delivery with no legal implications

- Share warrants are accepted as a form of security when applying for a bank loan

- Some Share warrants are entitled to future dividends which represent a future income

Disadvantages of Share Warrants

- The bearer of a Share Warrant is not an actual member of the company

- Heavy stamp duties are charged for warrants (usually around 3% of the nominal value of shares)

- Approval of the Central government is needed to issue a Share Warrant, and this can be time-consuming

What is the difference between Share Certificate and Share Warrant?

Share Certificate vs Share Warrant | |

| Share certificate is a proof document issued to indicate the ownership of shares by an investor in a company. | Share warrant is a document that entitles the bearer the right of acquiring shares of the company in the future. |

| Ownership | |

| A Holder of a Share Certificate is a member of the company. | A Holder of a Share Warrant is only the bearer of the instrument. |

| Issuance | |

| Share certificate can be issued by both private and public companies. | Share warrant can only be issued by a public limited company. |

| Originality | |

| Share Certificate is an original document. | Share Warrant cannot be issued originally |

| A share certificate is converted into a share warrant once the shares are fully paid. | |

| Regulations | |

| Approval of central government is not needed. | Approval of central government is mandatory. |

Reference:

“Advantages and Disadvantages of investing in shares.” HubPages. HubPages, n.d. Web. 31 Jan. 2017.

” Classes of shares.” Company Law Club . N.p., n.d. Web. 31 Jan. 2017.

“Complete information on issue of share warrants : its conditions & effects.” PublishYourArticles.net – Publish Your Articles Now. N.p., 22 June 2015. Web. 31 Jan. 2017.

Jeferson. “Share Warrant | Meaning | Conditions | Merits and Demerits.” Money Matters | All Management Articles. Money Matters | All Management Articles, 31 July 2016. Web. 31 Jan. 2017.

“Shares, Stocks and Marketable Securities.” Revenue. N.p., n.d. Web. 31 Jan. 2017.

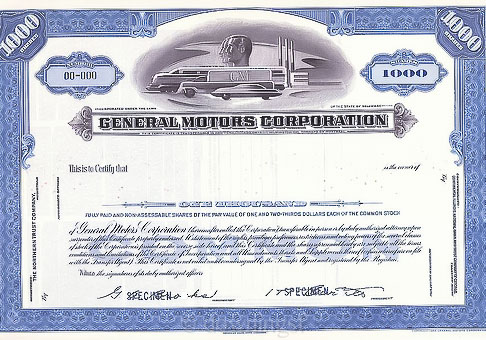

Image Courtesy:

“General Motors Corporations Specimen Stock Certificate” By Downingsf – Own work (CC BY-SA 3.0) via Commons Wikimedia “RegisteredWarrantSample” By Greensburger – Own work (Public Domain) via Wikimedia CommonsncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26%2Fx5qpnmWTmr%2B1tcWimpqslWKur7CMr6pmq5iWv6Z51pqpq5meqXw%3D