Difference Between Materiality and Performance Materiality

Table of Contents

Key Difference – Materiality vs Performance Materiality

According to Audit & Assurance Services Policy (AASP), the concept of materiality is applied by the auditor when planning and performing the audit since the auditor has to provide an opinion on whether the financial statements are materially correct. The key difference between materiality and performance materiality is that materiality refers to the state where financial information has the ability to affect economic decisions of users if some information is misstated, omitted, or not disclosed whereas performance materiality refers to the amount of variation that can exist in individual financial accounts due to errors and omissions without affecting the auditor’s opinion regarding the objectivity of financial statements.

CONTENTS

1. Overview and Key Difference

2. What is Materiality

3. What is Performance Materiality

4. Side by Side Comparison – Materiality vs Performance Materiality

5. Summary

What is Materiality?

In the context of audit, materiality refers to the state where financial information has the ability to affect economic decisions of users or the discharge of accountability by management or those charged with governance if the part of the information is misstated, omitted or not disclosed. Determining the materiality of the financial statements as a whole is a main goal of the overall audit strategy.

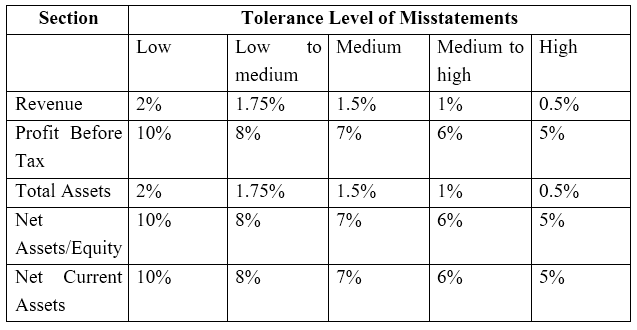

The major users of financial statements and the type of information that will be useful for them to make economic decisions should be considered by auditors when deciding the level of materiality. The risks that the company is exposed to are also important to consider when assessing the same. Audit & Assurance Services Policy (AASP) has determined the tolerance level of misstatements for the main sections in the financial statements.

Overall materiality is based on needs and expectations of the users of financial information (should be a group of users; possible effect of misstatements on specific individual users is not considered), not those of the auditor based on audit risk.

Figure 01: Auditors assess whether the financial statements present a true and fair view

What is Performance Materiality?

Audit & Assurance Services Policy (AASP) defines performance materiality as “the amount or amounts determined by the auditor, based on the assessed level of risk at the financial statement level, which is less than materiality for the financial statements as a whole. The amount of performance materiality is considered necessary to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements is greater than materiality.”

In other words, this refers to the amount of variation that can exist in individual financial accounts due to errors and omissions without affecting the auditor’s opinion regarding the objectivity of financial statements. Performance materiality does not have to be set for all individual accounts as this can be done for a selected set of accounts or for a particular class of accounts. Determination of performance materiality is conducted for the purpose of assessing audit risk.

E.g. ABC Ltd. is a retail organization that makes a lot of credit purchases and holds large amounts of inventory. Since inventory and creditors amount to a significant portion of their business, ABC Ltd maintains a performance materiality of 2% for inventory and creditors accounts.

What is the difference between Materiality and Performance Materiality?

Materiality vs Performance Materiality | |

| Materiality refers to the state where financial information has the ability to affect economic decisions of users or the discharge of accountability by management or those charged with governance if some information is misstated, omitted or not disclosed. | Performance materiality is the amount of variation that can exist in individual financial accounts due to errors and omissions without affecting the auditor’s opinion regarding the objectivity of financial statements. |

| Scope | |

| Level of materiality is based on the needs and expectations of the users of financial information. | Level of performance materiality is based on the assessment of audit risk. |

| Nature | |

| Materiality is a standalone concept. | Performance materiality depends on the level of materiality. |

Summary- Materiality vs Performance Materiality

The difference between materiality and performance materiality depends on allowing a fair and objective representation of financial statements free of material misstatements (materiality) and the level of materiality acceptable for individual accounts (performance materiality). Both materiality and performance materiality may be subjected to change over time; for example, if the auditor determines that a lower materiality for the financial statements than what was initially determined is appropriate, performance materiality can also be changed accordingly.

Reference:

1. Rogers, Hill , and Spencer Steer. MATERIALITY GUIDE. Tech. N.p.: NSW ICAC EXHIBIT, n.d. Print.

2. Collings, Steven. “Performance materiality: What’s all that about?” AccountingWEB. N.p., 28 Apr. 2016. Web. 23 May 2017. <http://www.accountingweb.co.uk/practice/general-practice/performance-materiality-whats-all-that-about>.

3. Ullah, Azmat. “ISA 320 Summary Materiality in planning and performing audit.” LeAccountant.com. N.p., 04 Sept. 2016. Web. 23 May 2017. <http://leaccountant.com/2014/12/17/isa-320-summary-materiality-in-planning-and-performing-an-audit/>.

Image Courtesy:

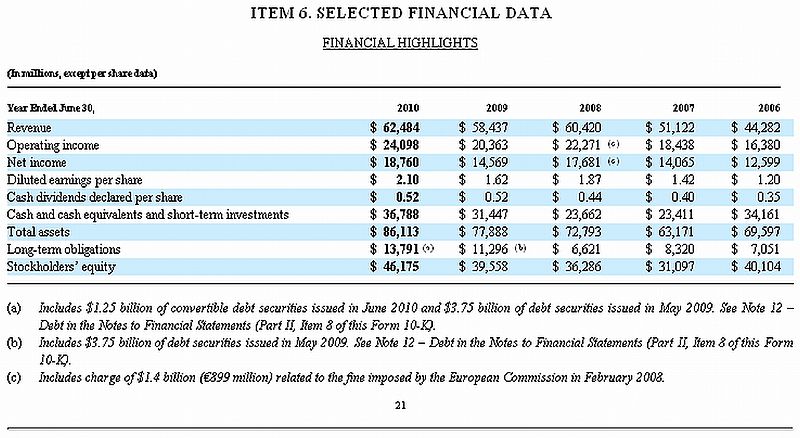

1. “Microsoft 10-K Fiscal 2010 Selected Financial Data” By Microsoft – Microsoft (Public Domain) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau265wK2cq6GRoba1xYyapZ1lpqh6sbHRn6arpZGjsKZ5zJqrnqqZlrmqwNho