Difference Between Angel and Seed Funding

Table of Contents

Key Difference – Angel vs Seed Funding

Due to the limited scale of small businesses and entrepreneurs, gaining access to funds required for expansion often becomes a challenge since funding options such as share issues are not available. While the majority of investors prefer to invest in well-established businesses, some invest in small-scale startups. Angel investors and seed funding are such small scale business investment options. The key difference between angel and seed funding is that while angel funding provides both monetary and business development skills to startups, investors of seed funding are primarily interested in an equity stake.

What is Angel Funding

Angel funding is the investments made by angel investors. Angel investors are a group of investors that invest in entrepreneurs and small scale startup businesses. Angel investors are also referred to as private investors or informal investors. These investors are generally high-net-worth individuals who not only have the funds that they are willing to lend, but also the business expertise that can help entrepreneurs and startup businesses with their decision making. These investors are typically former employees who have held senior management positions in reputable organizations or successful entrepreneurs. Their main objective is to gain financial returns from investing in the new businesses with high potential for growth.

Characteristics of Angel Funding

The type of businesses that different angel investors are willing to invest may vary. For instance, if a particular business angel investor is a former senior personnel in a technology based organization then he\she is likely to be interested in investing in a similar scale startup. Further, selecting a business proposal that is coherent with own experience allows the investor to contribute with operational expertise in addition to financial expertise, which is a commonly seen characteristic of business angels.

Angels make a high-risk investment since the future success or failure of entrepreneurs and startup businesses they invest in is unknown. The probable risk is also pertaining to the fact that these startups have minimal experience in conducting businesses. Thereby, if the new business fails to achieve the intended results, the angels may lose their invested funds completely. Thus, angels require higher returns due to the greater risks undertaken. Generally, a return of 20%-30% may be expected by an angel on average. Sometimes angels may acquire an equity stake in the company.

Angel investors can contribute with a single investment or multiple investments to help the startup to stabilize itself as a capable business operation. They keep funding a start up until such time the venture is adequately stabilized and is capable of carrying out a successful operation. Also, if the business does not perform as expected within a given period of time, then the investor may decide to withdraw himself/herself from the business. This is referred to as an exit route. The exit routes are often carefully planned by angel investors before making the initial investment. For example, if the angel investors have an equity stake in the business he or she will decide to sell it to another interested party as an exit route. Globally, UK Business Angels Association (UKBAA) and European Business Angel Network (EBAN) are representatives of investor communities for startup businesses.

What is Seed Funding?

Seed funding, also known as seed capital, refers to investing in a startup business by obtaining an equity ownership or convertible debt in it. Equity stake equals to a unit of ownership in the business and investors in seed funding thereby becomes shareholders of the business and have the ability to influence the decisions of the business. Convertible debt can be converted into equity shares at a future date.

Characteristics of Seed Funding

The founders of the business can get their family members, friends, and other acquaintances to invest in the startup business. Unlike angel investors, investors of seed funding do not possess advanced skills to advise on business operations.

Further seed funding is not limited to startup businesses but can be used as a source of financing for ongoing businesses as well. Many established companies use seed funding to gain access to financing. Recently Debut, a UK-based provider of a student recruitment app, raised finance through seed funding.

What is the difference between Angel and Seed Funding?

Angel vs Seed Funding | |

| Investors are high net worth individuals who can contribute with large amounts personal wealth | Entrepreneurs can get their family, friends, and acquaintances to contribute with funding |

| Funding | |

| Investors contribute with their own business expertise in addition to capital funding | Investors provide capital funding; expert advice is usually not provided |

| Equity Stake | |

| Angels do not require an equity ownership or convertible debt in the start up | Seed funding requires an equity ownership or convertible debt in the company |

Reference:

Root. “Angel Investor.” Investopedia. N.p., 11 Sept. 2015. Web. 24 Jan. 2017.

“UK Business Angels Association (UKBAA).” UK Business Angels Association (UKBAA). N.p., n.d. Web. 24 Jan. 2017.

“Home.” EBAN – The European Trade Association for Business Angels, Seed Funds and Early Stage Market Players. N.p., n.d. Web. 24 Jan. 2017.

Image reference:

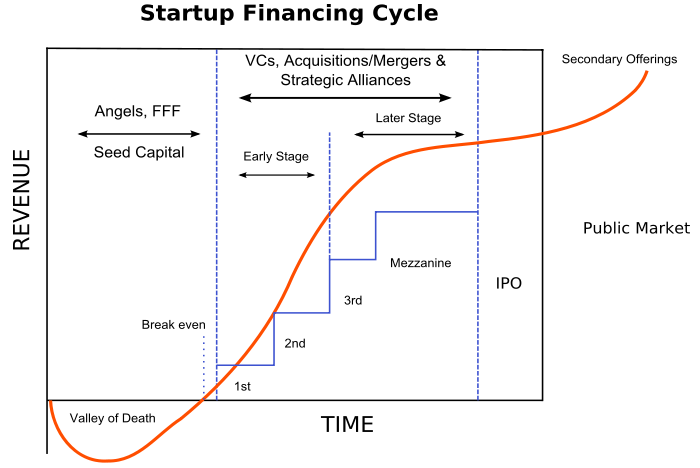

“Startup financing cycle” By Kmuehmel – Own work by uploader, derived from Startup_financing_cycle.JPG by Kompere (CC BY-SA 3.0) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26tzaCcpWWRo7FuwtJmqp6dlGKztrrDoqWgZw%3D%3D